Invest like a pro

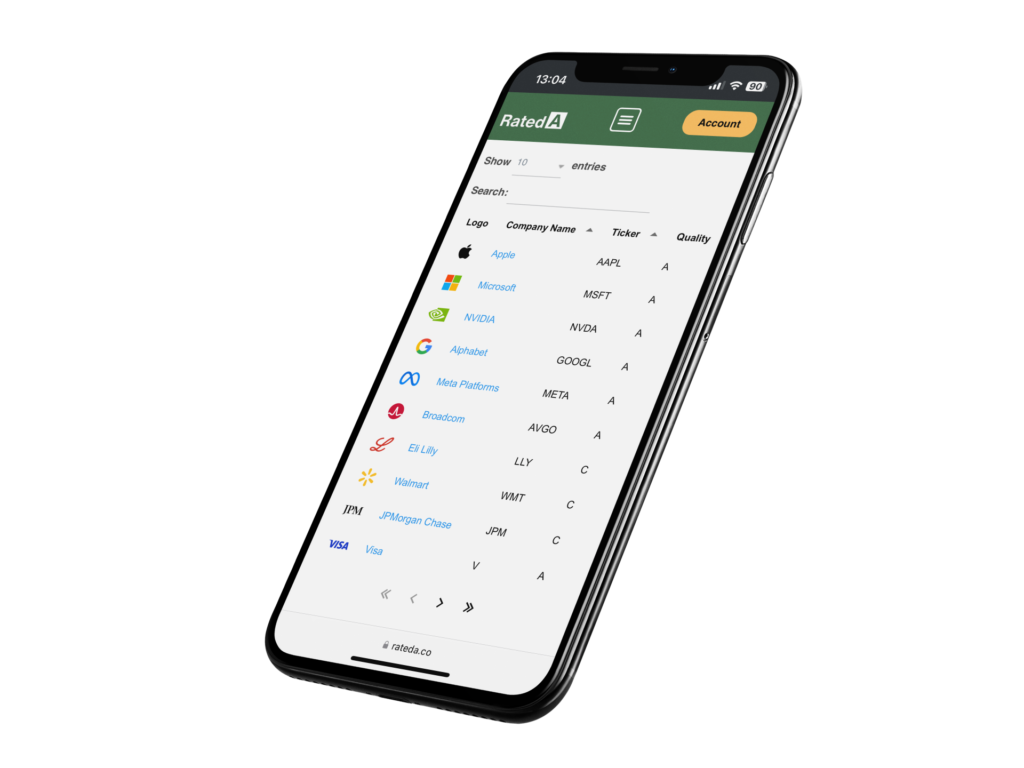

Stop guessing: improve your returns by investing in the world's best companies

A transparent track record

The RatedA portfolio is constructed from our database’s top quality companies and managed with a long-term mindset.

| Period | RatedA | MSCI World | S&P 500 |

|---|---|---|---|

| 2025 | 36.13 | 21.48 | 17.88 |

| 2026 YTD | 2.53 | 1.67 | 1.29 |

| CAGR | 19.33 | 11.58 | 9.59 |

What our members are saying

I stoped chasing random stock tips and started focusing on quality. I made a couple of better decisions within the first few months and the subscriptions basically paid for itself.

RatedA Member, 2025

I used to panic on red days and feel amazing on green days. Now I always feel calm because I actually understand what I own and why.

RatedA Member, 2025

RatedA taught me how to think about fundamentals, and the real-money portfolio gives me a simple model to follow. I’m so much more independent now.

RatedA Member, 2025